Did you know that in recent years, business engagement teams have begun to cut corners on PCAOB standards regarding audit documents? This is a major issue, considering how important such documents are to the maintenance of a company’s finances.

What is the Purpose of Audit Documents?

The purpose of an audit document is to get an overview of a company’s financial statements to make sure they are compliant with laws and regulations. Audit documentation is a form of documentation that shows procedures applied in an auditing process by the auditor. Similarly, auditors will include evidence obtained and conclusions reached in the audit document.

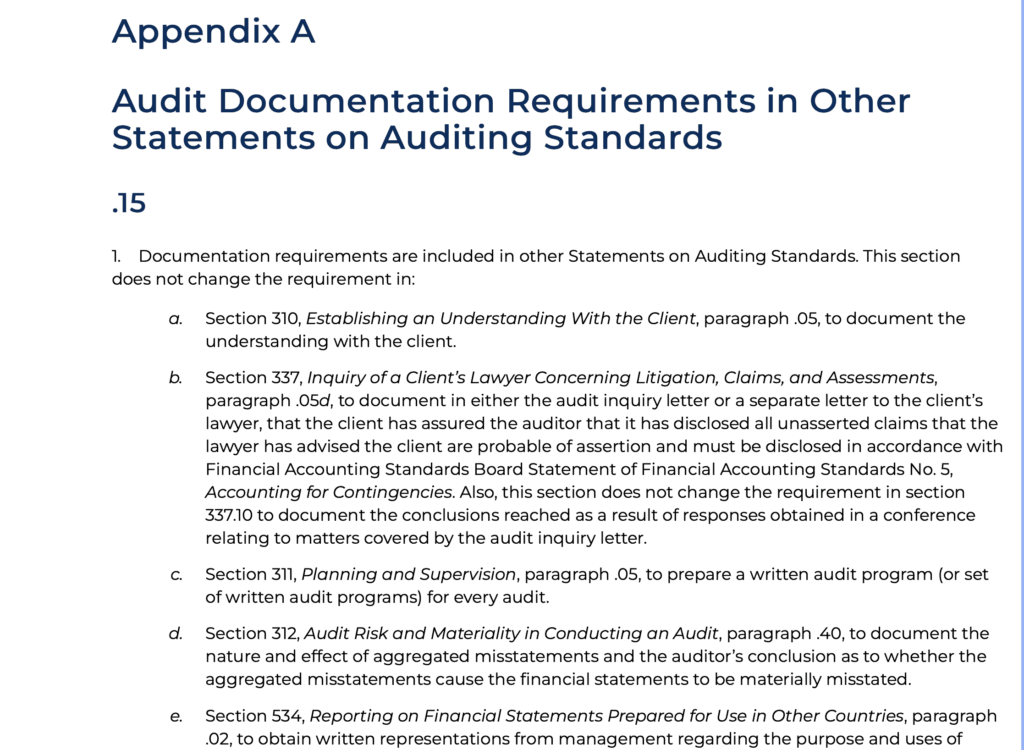

Additionally, the content of each document can vary in quality and type based on the professional’s judgment. Audit documents can also hold specific document requirements – such as Appendix A Paragraph 15. Above all, an audit document needs to aid the auditor in conducting and supervising an audit.

What are the Different Types of Audit Documentation Evidence?

The type of evidence used can vary between audit documents depending on those documents’ specific purpose. Listed below are some of the most commonly used forms of evidence.

- Physical Analysis: Auditors will typically complete a physical analysis to confirm the existence and or condition of. This type of examination is a major source of audit evidence for fixed assets.

- Confirmations: This type of documentation relies on third parties to confirm various aspects of financial statements. Third parties are entities, such as banks, that confirm an accounts’ payable records.

- Documentary Evidence: This evidence consists of internally processing documents, emails, and logs. Auditors use this documentation evidence to vouch and trace parts of the auditing procedure.

- Analytical Procedures: Auditors will usually use this procedure to perform their calculations. In this way, analytical procedures help provide accurate evidence and truth regarding financial statements and any other accounting records given by clients.

- Oral Evidence: Auditors will typically interrogate company leaders about business operations before designing the auditing procedures.

- Accounting Systems: This typically serves as a source of auditing evidence. It allows the auditor to access financial reporting documents and anything interconnected with financial statements.

- Re-Performance: A company’s control risks identify shortcomings by using key internal control processes.

- Observational Evidence: Auditors will often observe and take notes of how a client processes their work. They specifically observe how the client goes about handling operations, policies, and protocols to find their weaknesses.

What Does an Audit Document Include?

Audit documents are typically used to show that certain standards in the have been observed and are being met. This includes confirming that:

- Work was properly performed and supervised

- A certain degree of internal control has been obtained to plan, determine, and time the extent to which tests were performed in the audit process

- Sufficient evidence is obtained during the auditing process to form an opinion on a reasonable basis

Interestingly enough, audit documents can be used as audit evidence. Moreover, examples of documents/evidence can consist of audit programs, analysis, confirmation/representation letters, entity documentation copies, and schedules prepared by the auditor. This type of documentation can be in the form of paper, electronic documentation, or any other form of media.

When determining the extent of audit documents, the auditor should consider the following factors:

- Material misstatement related to an assertion, account, or class transaction

- The degree of judgment associated with performing tasks while evaluating results

- Nature of the auditing process

- Up-to-date evidence with approval

- Any exceptions identified, as well as their nature and extent

- The possibility of not being able to document the basis of a conclusion from the available documentation of work performed

Furthermore, auditors should also include documentation of any issues they see, based on their own experience and judgment. Auditors also need to include evidence to back up their conclusions on the issues addressed and their conclusions reached. Listed below are some common significant audit issues:

- Issues involving appropriate selection, application, and consistency of accounting principles concerning financial statements, which can also include matters of related disclosure

- Auditing procedure results that indicate financial statements and/or disclosures that could be inaccurate in the content. This also includes auditing procedures that need to be modified and/or updated.

- Any situations that can hinder the auditor from completing the auditing process and reaching a conclusion

- Any findings that could lead the auditor to modify their reports

When creating audit documentation, these topics and factors should be taken into consideration to ensure the documentation is as effective and informative as possible.

A technical writer can help streamline the process of audit documentation and sort out all these potential issues. They are uniquely capable of translating audit documentation to be easily understood.

What is the Importance of Audit Documentation?

The role of audit documentation can be important in many cases, as it serves many different roles and benefits in the auditing process. A few of the most common benefits are listed below:

- Supporting Evidence: Audit documentation shows the procedures performed, the tests conducted, and the results obtained.

- Transparency and Accountability: Audit documentation allows other auditors, regulators, or stakeholders to review and understand the audit work that was performed.

- Facilitated Communication: This type of documentation helps auditors communicate their findings and recommendations to various stakeholders, including management, audit committees, regulatory bodies, and external parties.

- Quality Control: Audit documentation ensures that audit procedures are consistently applied, and that the work is conducted in compliance with auditing standards and guidelines.

- Review and Supervision: This documentation enables parties to provide feedback, guidance, and oversight to ensure that the audit engagement meets professional standards.

All considered, in terms of maintaining integrity, quality, and credibility, audit documentation is essential. These documents provide a structured record of the work performed, evidence gathered, and conclusions reached, serving as a foundation for informed decision-making and effective communication.

Other Factors to Consider with Audit Documentation

It should be noted that the auditor has complete ownership of the audit document. Similarly, several states provide legal details in their respective statutes. In addition, the auditor should maintain reasonable procedures long enough to meet the project’s needs and satisfy any legal requirements for record retention.

Further, auditors have an ethical obligation to censor and keep client information confidential. The auditor should adopt reasonable procedures that help maintain the confidentiality of a client’s information and consider adopting procedures that can restrict unauthorized access to an audit document. These can include such measures as cybersecurity documentation and similar documents and procedures. Lastly, at times, certain audit documents can serve as a reference tool. Clients should not, however, use these documents as substitutes for their accounting records.

Audit documents are used to document records of planning, work performance, procedures performed, evidence obtained, and conclusions reached by the auditor.

How EDC Can Help with Audit Documentation

If you’d like to learn more about audit documentation and what it can do for you, check out some of our other content below:

- How to Assemble Audit Documentation

- Compliance Documentation is Important for Success

- Why Technical Writers Are Necessary For SOX Compliance

Whether you need a single technical writer for a brief project or a team of consultants to produce a complete line of documentation, the quality of our work is guaranteed for you. Our clients work closely with an Engagement Manager from one of our 30 local offices for the entire length of your project at no additional cost. Contact us at (800) 221-0093 or [email protected] to get started.